How the new HST transition rules affect new homes in BC

Saturday, February 18th, 2012The transitional tax rules for new homes in B.C. announced on Friday by Finance Minister Kevin Falcon are significantly more generous than the old ones.

The rule changes are intended to keep the tax burden on most newly-constructed homes at the same level that they were under the old PST regime, that they are under the current HST and that they will be when the PST is reinstated on April Fool’s Day next year. But three provisions make this a sweeter deal for builders and buyers:

. The threshold for a substantial tax rebate has been raised from $525,000 – a ludicrously low amount in the Lower Mainland, which is Canada’s most expensive housing market – to $825,000.

. Buyers of higher-priced homes will also benefit because they’ll pay tax only on the amount over and above the exemption.

. Recreational homes in most of B.C. will be eligible for the tax break for the first time.

The increased exemption goes a long way to address one of the most serious criticisms of the well-structured but badly implemented HST that has caused the governing Liberals so much grief. The exemption was so low and homes are subjected to so many taxes that the HST became yet another driver of sky-high urban house prices.

Would British Columbians’ reaction to the HST have been less visceral and less powerful if measures like these had been adopted from the start?

We’ll never know.

But maybe, just maybe, this more realistic approach indicates the government at least learned a lesson from the voter rage that drove former premier Gordon Campbell from office.

Since houses take a long time to build, the policy recognizes that many will be started under one tax regime and finished and sold under another. Falcon said the objective is to keep the tax burden the same, regardless of the timing.

In the old PST era, there was no provincial tax on the selling price of a new home, but builders paid PST on materials they used. The PST added, on average, two per cent to the total cost of the home.

When the HST was implemented, the seven-per-cent provincial tax applied to the selling price of the house, but the government said it wanted to keep the tax burden at the same level as under the PST. So it implemented a rebate of up to $26,250 (now raised to $42,500) to bring the effective provincial tax rate down to two per cent on the first $525,000.

When the PST resumes next year, the assumption is that the PST will, once again, add about two per cent to the cost of each new home.

Those prices should all work out to be equal.

The problem Falcon had to address was what to do about houses started under one tax regime and finished under another.

Depending on the timing and the policy, it’s easy to come up with scenarios where buyers might be able to duck both taxes, or where they might be dinged with both.

Falcon’s solution is a two-per-cent transitional tax on homes built with tax-free materials and sold with no HST applied. It’s a bit more complex than that, because it has a provision to consider what portion of the materials are bought and what portion of the home is completed under each tax regime.

Complex tax policies always create opportunities for unfairness. But Janice Roper, a specialist on indirect taxes at the Vancouver office of Deloitte, tells me the rules appear to be comprehensive, fair and hard to manipulate.

Peter Simpson, president and CEO of the Greater Vancouver Home Builders’ Association, said they provide the certainty his builders want, and they were announced sooner and with better terms than expected.

So – thus far, at least – Falcon seems to be finding his way through the HST minefield he inherited with his new job.

Source: Don Cayo, The Vancouver Sun

Canadian property sales show the biggest fall since July 2010

Friday, February 17th, 2012Residential property sales in Canada fell 4.5% from December last year to January 2012, the biggest monthly fall since July 2010, the latest figures from the Canadian Real Estate Association (CREA) show.

It was also the first monthly fall since August 2011. The monthly decline reversed a string of monthly increases over the closing months of last year, and returned national activity to where it stood at the end of the third quarter of 2011.

Last year was also muted in terms of price increases, with the national average home price up less than 2% year on year in January, one of the smallest increases of the last 12 months.

The actual (not seasonally adjusted) national average price for homes sold in January 2012 was $348,178, representing an increase of 1.2% from its year ago level. This ranks among the smallest increases since late 2010.

On a seasonally adjusted basis, the national average home price rose 1.6% on a month on month basis, marking a rebound from a decline of similar magnitude in December.

“The national housing market is stabilizing and remains well balanced. That said, forecasts for economic and job growth going forward vary widely for different parts of the country, suggesting a possible continuation of a softening trend in some markets, as well as the potential that demand will pick up based on strong fundamentals in others,” said Gary Morse, CREA’s president.

Activity was down in over half of all local markets in January from the previous month. Led by declines in Greater Toronto and Montreal, demand also softened in a number of other major urban centres including the Fraser Valley, Calgary, Edmonton, Winnipeg, Ottawa, and the Greater Vancouver housing market.

Actual (not seasonally adjusted) national sales activity was up 4% from year ago levels in January, the smallest year on year increase since last May. As was the case in a number of months last year, actual sales in January 2012 stood close to the five and 10 year average for the month.

The number of newly listed homes edged down 1.4% on a month on month basis in January following a 2.9% increase in December. The monthly decline in new supply reflects a drop in new listings in a number of Canada’s largest urban centres, which offset a jump in new listings in Vancouver, CREA said.

Sales fell in January shifting the national market back towards the mid point of balanced territory and reversing the recent trend which had seen the market becoming tighter over the final four months of 2011. The national sales-to-new listings ratio, a measure of market balance, stood at 53.8% in January, down from 55.5% in December and 55.4% in November.

Based on a sales-to-new listings ratio of between 40 to 60%, some 60% of local markets were balanced in January. Compared to December, there were fewer buyers’ and sellers’ markets, and a greater number of balanced markets.

The number of months of inventory stood at six months at the end of January on a national basis, up from 5.7 months in December 2011 and returning it to where it stood in October 2011. The number of months of inventory represents the number of months it would take to sell current inventories at the current rate of sales activity, and is another measure of the balance between housing supply and demand.

“Year on year comparisons in the national average price are expected to become volatile and may turn negative, reflecting average price developments in the first half of 2011 in Vancouver,” said Gregory Klump, CREA’s chief economist.

“At that time, high-end home sales in Vancouver’s priciest neighbourhoods surged to all-time record levels, which skewed the national average price upward considerably. A replay of this phenomenon is not expected this year,” he explained.

“As a result, comparisons for national average price to year ago levels over the coming months will reflect an upwardly skewed base effect. For this reason, year-on-year comparisons should be kept in perspective. Developments in the MLS® HPI will provide important guidance on price trends, since it is not affected by the problem of compositional shifts in the mix of sales activity,” he added.

Source: PropertyWire

Will Canadian home prices have the same correction as the US?

Friday, February 3rd, 2012In few corners of the world would a car park squeezed between two arms of an elevated highway be seen as prime real estate. In Toronto, however, a 75-storey condominium is planned for such an awkward site, near the waterfront. The car park next door will become a pair of 70-storey towers too. In total, 173 sky-scrapers are being built in Toronto, the most in North America. New York is second with 96.

When the United States saw a vast housing bubble inflate and burst during the 2000s, many Canadians felt smug about the purported prudence of their financial and property markets. During the crash, Canadian house prices fell by just 8%, compared with more than 30% in America. They hit new record highs by 2010. “Canada was not a part of the problem,” Stephen Harper, the prime minister, boasted in 2010.

Today the consensus is growing on Bay Street, Toronto’s answer to Wall Street, that Mr Harper may have to eat his words. In response to America’s slow economic recovery and uncertainty in Europe, the Bank of Canada has kept interest rates at record lows. Five-year fixed-rate mortgages now charge interest of just 2.99%. In response, Canadians have sought ever-bigger loans for ever-costlier homes. The country’s house prices have doubled since 2002.

Speculators are pouring into the property markets in Toronto and Vancouver. “We have foreign investors who are purchasing two, three, four, five properties,” says Michael Thompson, who heads Toronto’s economic-development committee. Last month a modest Toronto home put on the market for C$380,000 ($381,500) sold for C$570,000, following a bidding war among 31 prospective buyers. According to Demographia, a consultancy, Vancouver’s ratio of home prices to incomes is the highest in the English-speaking world.

Bankers are becoming alarmed. Mark Carney, the governor of the central bank, has been warning for years that Canadians are consuming beyond their means. The bosses of banks with big mortgage businesses, including CIBC, Royal Bank of Canada and the Bank of Montreal, have all said the housing market is at or near its peak. Canada’s ratio of household debt to disposable income has risen by 40% in the past decade, recently surpassing America’s (see chart). And its ratio of house prices to income is now 30% above its historical average—less than, say, Ireland’s excesses (which reached 70%), but high enough to expect a drop. A recent report from Bank of America said Canada was “showing many of the signs of a classic bubble”.

The consequences of such a bubble bursting are hard to predict. On the one hand, high demand for Canada’s commodity exports could cushion the blow from a housing bust. And since banks have recourse to all of a borrower’s assets, and Canadian lending standards are stricter than America’s were, a decline in house prices would probably not wreck the banks as it did in the United States.

However, the Canadian economy is still dependent on the consumer. Fears about the global economy have slowed business investment, and all levels of government are bent on austerity. The Conservative government’s next budget is expected to put forward a plan to close the federal deficit, now 2% of GDP, by 2015—modest austerity compared to Europe’s, but still a drag on the economy. Few new jobs are being created. Assuming there is no setback in Europe’s debt crunch, slowdown in America or drop in commodity prices, GDP is forecast to grow by a meagre 2% this year. If consumers start feeling less well off, Canada could slip back into recession.

The inevitable landing will probably be soft. Increases in house prices and sales volumes are slowing, and the 2015 Pan American Games in Toronto should prop up builders. “The national housing market is more like a balloon than a bubble,” says a report by the Bank of Montreal. “While bubbles always burst, a balloon often deflates slowly in the absence of a ‘pin’.”

Moreover, the government is trying to cool the market. The banking regulator is increasing its scrutiny of housing in response to concerns about speculators. The Canada Mortgage and Housing Corporation, a government mortgage-insurance agency, says it will have to start reducing its new coverage because of legal limits. And the finance ministry has cut the maximum term of publicly insured mortgages from 35 years to 30. Some bank managers are calling for it to be reduced to 25, the historical norm. Canada’s reputation for financial sobriety is not entirely unwarranted.

However, the state has refused to use its most powerful tool. To protect business investment, the central bank has made clear that it plans to keep interest rates low. As long as money stays cheap, the balloon could get bigger—perhaps big enough to become a fully fledged bubble after all.

Source: The Economist

It’s not just Vancouver – Vancouver Island homes are selling fast with prices up too!

Friday, February 3rd, 2012More homes are selling in Nanaimo, and at a higher price than this time a year ago.

A total of 62 units sold in the city last month, a 13% increase from a year ago, with the average selling price up 6% to $360,799, according to the latest sales summary from Vancouver Island Real Estate Board.

As the largest city in the region, which spans Vancouver Island north of the Malahat, Nanaimo outperformed the regional average in January, based on VIREB sales data.

On average, properties sold for 3% more region-wide in January than in the same period in 2010, while unit sales rose 5%.

The average prices paid for homes that sold last month was 93% of list price, down 1% from a year ago.

“There’s activity in the market,” said VIREB past-president Jim Stewart.

“There’s not urgency. People seem to really want to look at things.”

All but one of six VIREB zones saw year-over-year selling price increases last month.

The increase ranged from 2% in Campbell River to 9% in Cowichan Valley.

Comox Valley and Port-Alberni both saw 4% changes from 2011.

The single price drop happened in Parksville-Qualicum Beach, down 12% to $341,696.

The supply of single-family homes rose 6% from a year ago, to 640 units in the VIREB region last month.

Days to sell increased 2%, with the average home staying on the market 89 days.

Condominiums are taking longer to sell, especially apartment condos.

Townhouse condos are fetching 96% of list price after an average listing period of 102 days, while patio condos are taking 151 days to sell, also at 96% of list price.

On average, apartment condos sitting on the market 191 days before closing, with the average unit fetching just 89% of list price.

More of the same is in store for the year ahead.

“While the market is not going to be sexy this year, it’s performance looks pretty average,” said Cameron Muir, the B.C. Real Estate Association’s chief economist.

Source: Darrell Bellaart, Nanaimo Daily News

Is there a housing crash coming to Canada?

Tuesday, January 31st, 2012The Bank of Montreal poured cold water on the idea Canada’s housing market could be headed for a crash, suggesting that prices are only “moderately high across the country.”

“Expect the housing boom to cool rather than crash,” BMO’s chief economist Sherry Cooper and senior economist Sal Guatieri said in a report published Monday.

“While the housing boom is unlikely to continue unless mortgage rates drop much further, neither is it likely to bust.”

The bank says home values are indeed rising at a faster pace than they used to, but the signs are pointing to a soft landing where prices stabilize — not a hard correction where prices drop quickly by 20 per cent or more.

“In our view, the national housing market is more like a balloon than a bubble,” the bank said. “While bubbles always burst, a balloon often deflates slowly in the absence of a pin.”

But demographic factors, consistently low interest rates, low construction costs and an influx of foreign buyers make it likely that no such pin will materialize for the foreseeable future, the bank said.

Average prices have grown more than twice as fast as family incomes since 2001, but BMO’s report argues there’s no reason to panic yet.

Nationally, home prices are 4.9 times higher than the average household income. A decade ago, that ratio was at 3.2.

Some cities are hotter than others. Vancouver’s home prices ratio currently sits at 10 times higher than average household income, Toronto’s is at 6.7, Montreal’s is at 4.5 while Halifax is at 3.8. Those are all on the high side, but if the market cools, that will allow incomes to catch up and move the price-to-income ratio lower, the bank argues.

The latest data from the Canadian Real Estate Association shows the national average price was $347,801 in December, a 0.9 per cent increase over the previous 12 months. That was the lowest level of growth since October 2010 and well below inflation, a possible sign that the market is already cooling.

The bank does note, however, three risks to the outlook. A sudden hike in interest rates, a widespread Canadian recession, or an economic slowdown in Asia reducing the number of foreign buyers would all take the air out of Canada’s housing market.

“But barring one of these triggers, however, a dramatic correction is unlikely,” the bank said.

Canadian home prices fell in 8 of 11 cities in November

Thursday, January 26th, 2012Apparently the only way isn’t always up.

Canadian house prices dropped in November for the first time in nearly a year, according to the monthly Teranet-National Bank house price index released Wednesday.

The 0.2 per cent drop followed two months of flat prices, and was the first decline in the index since a “brief correction during the three months ending November 2010,” said National Bank senior economist Marc Pinsonneault.

The national composite index, which tracks registered prices of homes sold at least twice, shows prices fell in eight of the 11 metropolitan markets tracked — one more than in October.

“Calgary and Victoria stood out with declines of 1.6 per cent and 0.9 per cent respectively,” said Pinsonneault, noting the declines were much smaller in the other six markets, though declines in Toronto, Hamilton and Winnipeg “are noteworthy in that these three markets are considered tight.”

December data released by the Canadian Real Estate Association suggested most real estate markets in the country are balanced, with the exception of those three cities, and Victoria, which is considered to be a buyer’s market.

November’s prices were higher than October’s in Edmonton (0.1 per cent), Montreal (0.4 per cent) and Halifax (0.5 per cent).

Year over year, the composite index has gained 7.1 per cent, up slightly from 7.0 per cent the previous month because of a bigger drop in prices between October and November in 2010.

“Since prices began rising again in December 2010, the recent acceleration trend in 12-month changes could come to an end with next month’s report on December 2011 prices,” Pinsonneault said.

Source: Postmedia News

November housing prices (% change m/m | % change y/y):

Calgary -1.6 | 0.5

Edmonton 0.1 | 1.0

Halifax 0.5 | 2.8

Hamilton -0.3 | 4.4

Montreal 0.4 | 7.2

Ottawa -0.2 | 4.2

Quebec -0.2 | 6.0

Toronto -0.2 | 10.8

Vancouver -0.2 | 9.1

Victoria -0.9 | -0.3

Winnipeg -0.1 | 7.5

National Composite -0.2 | 7.1

Source: Teranet-National Bank

If you want housing affordability – move to Edmonton !

Thursday, January 26th, 2012Edmonton enjoys the most affordable housing of Canada’s six major metropolitan regions, according to a study released Monday.

The International Housing Affordability Survey looks at housing in cities in the United States, the United Kingdom, Canada, Australia, Ireland, and New Zealand along with Hong Kong. It found that among Canadian cities with populations above one million, Edmonton has the most affordable housing.

Windsor was the most affordable market of any size, while Vancouver was by far the priciest market in the country. In fact, Vancouver outranked every city in the survey except Hong Kong, topping markets like New York City, San Francisco, Sydney and London, England.

Conducted by the public policy website Demographia and based on data from the third quarter of 2011, the study ranks cities by their “median multiple” — the median house price in an area divided by gross median household income. The survey labels any median multiple score over 3.0 as “unaffordable,” and a score above 5.0 as “severely unaffordable.”

Of the six biggest markets in Canada, Edmonton, Calgary and Ottawa-Gatineau earned the designation “moderately unaffordable,” and housing markets in Vancouver, Montreal, and Toronto scored as “severely unaffordable.”

The study, co-authored by American public policy consultant Wendell Cox and Kiwi real estate developer Hugh Pavletich, describes a sharp decrease in housing affordability over the last decade in the markets surveyed. It argues that median multiple scores should lie between two and three, but restrictive land-use regulations boost the price of housing, particularly in the U.K., New Zealand and Australia. The report classed all five of Australia’s major metropolitan areas as “severely unaffordable.”

Cox and Pavletich specially denounce urban growth boundaries, which restrict the amount of land available for new housing development in places like Auckland, New Zealand and Portland, Ore. The authors advocate repealing such legislation where it exists to restore housing affordability.

Cities in America, where the housing market plummeted in 2008, earned the most affordable scores. Detroit led all major cities with a score of 1.4, followed by Atlanta at 1.9 and then cities like Las Vegas, Cleveland and Phoenix.

Hong Kong, at 12.6, scored highest, followed by Vancouver at 10.6 and Sydney at 9.2. Melbourne, which scored 8.4, and the British district of Plymouth & Devon, at seven, rounded out the five least-affordable major markets surveyed.

Source: Lewis Kelly, Edmonton Journal

See how Canada fared in 2011’s global housing market

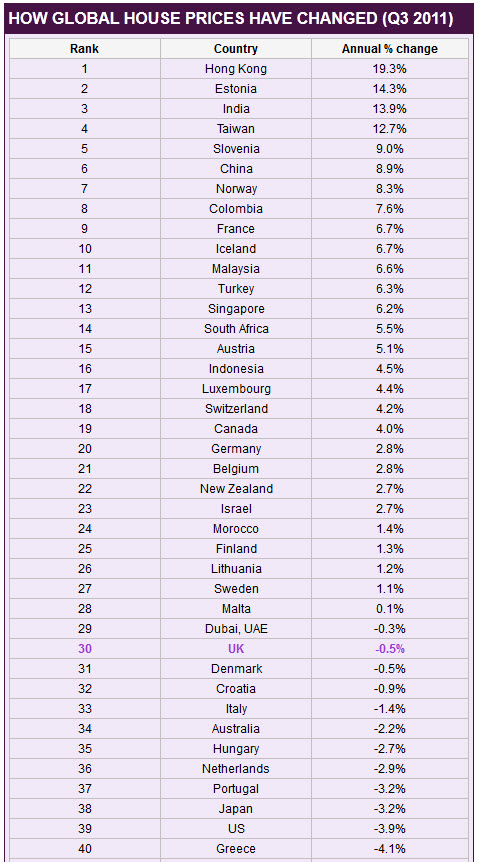

Wednesday, January 18th, 2012The global housing market suffered its worst performance for more than two years in the third quarter of 2011 according to UK property consultancy Knight Frank.

The company’s Global House Price Index rose by just 1.5% in the year to September 2011 – the worst level recorded since the second quarter of 2009 with house prices falling in more than half of the countries monitored in the third quarter.

Not surprisingly, Greece was one of the worst-performing countries, with prices falling 4.1% year-on-year. Hong Kong was the strongest, with prices rising 19% over the same period. However the city-state saw its prices drop 1.1% in the third quarter.

“The third quarter saw mounting pressures on the global economy with politicians seemingly helpless to get to grips with the eurozone debt crisis,” said Knight Frank. “This has reawakened fears of a double-dip recession, not just in Europe but around the world. Unsurprisingly, this economic uncertainty has been reflected in the performance of the world’s housing markets.”

At a regional level Europe was the worst performer, being the only area to record a negative growth (-0.5%) while luxury markets continued to hold strong.

“Luxury housing markets appear to be better insulated from this new weaker phase than mainstream markets,” added Knight Frank. “This is due in part to the scale of global wealth generation, the ongoing search for ‘safe-haven’ investments and the growing divide between prime markets in the West and the rest of the world.”

Other notable countries include China, 6th in the table with a 8.9 per cent rise, Germany, 20th with a 2.8 per cent rise, the US, 39th with a -3.9 per cent loss and troubled Greece, which came 40th, with the average house losing -4.1 per cent of its value.

Canada’s housing market fared well with prices up 4 per cent in 2011 compared to the year before. Rising property prices in Vancouver’s housing market have certainly contributed to this.

The price of homes in Canada is set to rise in 2012

Friday, January 13th, 2012The price of homes in Canada will continue rising this year, but Toronto and Vancouver’s housing markets will grow much more slowly, predicts the country’s largest real estate broker.

Low mortgage rates will continue underpinning housing demand despite the weakening economy, said Royal LePage Real Estate Services in its annual housing outlook Thursday.

LePage president and CEO Phil Soper said that predictions from housing experts and economists for a drop in prices for 2012 are wrong as mortgage rates remain near record lows.

“Interest rates are the primary driver behind activity levels in the marketplace,” Soper said. “People buy homes on the payments that they will be making, not on the sticker price of a particular home.”

Most experts believe interest rates will remain stable for this year and well into next as the economy expands sluggishly, but eventually rates should rise with stronger growth.

Royal LePage, which franchises real estate agencies across the country, predicted the national average price for resale homes will rise 2.8 per cent by the end of the year.

The forecast follows a gain of 4.2 per cent in the national average price for a standard two-storey home to $375,427 in the just completed fourth quarter of 2011.

In Vancouver, a standard two-storey home had an average price of $1.1 million in the fourth quarter, up 10.9 per cent from a year earlier, while Toronto saw a home in the same category gain 4.2 per cent to $629,000.

But for 2012, Royal LePage expects prices in Vancouver to gain about 2.3 per cent, while Toronto is expected to see growth of 2.6 per cent.

Regina is expected to lead the country with gains of five per cent for the year, reflecting the sharp growth in Saskatchewan, a province rich in potash, oil, uranium and other resources.

Soper noted that affordability in Vancouver is “on a knife’s edge” as people spend upwards of 70 per cent of their post-tax income on their mortgage, property taxes and utilities.

The economic slowdown in China may also affect the market in Vancouver, which has a large Chinese-Canadian population with economic and business ties to China.

“If the investment from China slows, it will change the high-end and certain neighbourhoods,” Soper said, noting that the west side of Vancouver, West Vancouver and Richmond have all seen in influx of wealthy Chinese buyers.

The International Monetary Fund has said that Canadian homes on average are 10 per cent overpriced and warned it may be a factor that puts the country’s economic recovery at risk.

The Bank of Canada has also repeatedly cautioned prospective buyers to guard against being lured by low mortgage costs because interest rates and therefore monthly payments, will eventually increase as the economy gets stronger.

However Soper suggested that moves made by Ottawa to tighten mortgage lending rules have helped limit the risks.

“The government has made small but significant regulatory changes that have restricted access to the more risky mortgage products post the recession,” he said.

The Royal LePage forecast came as the Statistics Canada reported the price of new homes rose again in November, led by gains in Toronto and Montreal.

The government agency’s new housing price index rose 0.3 per cent in November, after a 0.2 per cent increase in October. On an annual basis, the index was 2.5 per cent higher in November compared with November 2010.

The largest year-over-year price increases reported by Statistics Canada were in Toronto and Oshawa, Ont., where they were up 6.2 per cent.

In the fourth quarter, the average price for detached bungalows rose 7.2 per cent from a year earlier to $532,137; prices for standard two-storey homes rose 4.2 per cent to $629,188 and standard condos rose 3.4 per cent to $347,659.

In Victoria and Saint John, N.B., house prices were flat or slightly down in the fourth quarter year over year.

In Saint John, detached bungalows fell 2.2 per cent year-over-year to $179,946, while standard two-storey properties slipped 0.3 per cent to $298,076. Condos were the exception, with average prices climbing 16.1 per cent year-over-year to $159,370, although LePage said those increases weren’t typical.

In Victoria, standard two-storey homes were unchanged, with prices remaining at $480,000 while detached bungalows slipped 0.8 per cent to $486,000 and condos dropping 1.1 per cent to $282,000.

Source: Craig Wong, The Canadian Press