Recent conversation around the Kitsilano dinner table turned to – as it almost always seems to do – real estate and the role of foreign buyers in Vancouver.

The older guests decried the runup in prices that makes it almost impossible for their children to buy on the West Side, while the kids (also at the table), looked to their parents as the lender of first resort to help them get into the market.

But what to do about the oft-discussed “foreign buyer” typically tagged as a leading contributor to the pressures that make housing unaffordable? Charge a special tax on offshore buyers, asked one person? Charge a surtax on properties above a certain value, asked another? Or, as this writer chimed in, erhaps we want to introduce the equivalent of a head-tax on foreign investors simply because they’re coming to invest in properties. (Dirty looks all ‘round ensued.)

Or just suck it up?

Land ownership angst Tsur Somerville, associate professor with the UBC Centre for Urban Economics and Real Estate, noted that upward pressure on the price of local properties is a standard problem in desirable places to live – especially places that attract short-term residents, such as vacationers. Just ask the folks in Whistler, the Gulf Islands and other areas. “This is historically our biggest issue in places that are resorts: vacation homes drive up prices,” Somerville said.

The truth is, Canada is a nation of immigrants and each wave of newcomers has raised anxieties and concerns about land ownership. First Nations land claims are one example; restrictions the Islands Trust enforces on land uses in the sensitive Gulf Islands are another. Indeed, the fight for domestic control of land is as fundamental to Canada’s history as the story of settlement. Opposition to absentee landlords drove Prince Edward Island to join Canada in 1873, and provincial law still prevents non-residents from owning “in excess of five acres or having a shore frontage in excess of 165 feet unless he/she first receives permission to do so from the Lieutenant Governor in Council.”

Most of the Prairie provinces, where rights to real property are rooted in homesteading and distrust of bankers, also have restrictions on non-resident ownership of land. Canada isn’t alone in restricting foreign ownership: Iceland, Denmark and Australia, all members of the Organization for Economic Cooperation and Development, limit ownership of real estate to those resident in the country and prohibit renting by foreign owners.

Switzerland, a traditional haven for foreign capital, limits transactions by foreign buyers to a set

amount per year, and cities such as Zurich and Geneva are off-limits.

Poland and Greece have restrictions on land purchases; in Mexico – a popular vacation destination – a local bank holds property in trust for foreign owners. The foreigner has all the privileges and obligations of ownership, but not ownership itself. But globalization, and the international flow of capital that’s followed, has put the issue of foreign ownership on the front burner in many countries. The tide of capital seeking a safe haven following the September 11, 2001, terrorist attacks on New York and Washington, D.C., made countries take a hard look at how much cash they wanted in their jurisdictions and how much ownership they were willing to give away. Concern accelerated only after the real estate boom – and bust – that followed. Iceland has linked control of local assets to national sovereignty.

And even Prime Minister Stephen Harper has begged comparisons by moving to block foreign ownership of strategic assets. Australia recognized the challenges following a loosening of foreign ownership restrictions in late 2008. The following year saw a wave of foreign investment 30% above historical norms. The dramatic shift in a country where first-time homebuyers were already finding some cities unaffordable called for action. A six-month consultation period culminated in changes to Australia’s investment regulations in April 2010. All purchases by temporary residents and foreign non-residents became subject to approval by Australia’s Foreign Investment Review Board; temporary residents are limited to properties for their own use or development sites that would increase the housing stock.

Vacant land must be developed within two years, and foreign owners of residential properties must sell the properties when they leave the country or the government will confiscate and sell them instead. Australia’s introduction of tougher criteria for foreign real estate investment had an immediate effect. Approvals for purchases of residential real estate, typically the primary target of foreign investment applications, dropped from 2,450 to 647 – a 75% decline. Foreign restriction complications.

But could similar measures succeed in Vancouver?

During last fall’s civic election, independent council candidate Sandy Garossino called for restrictions on foreign ownership to address affordability. Affordability was being eroded by the foreign buyers. RBC Economics reported that a standard two-storey home in Vancouver required approximately 95.5% of the average household’s monthly income, while a detached bungalow required 92.5%. (A residence is considered affordable when it requires just 32% of household income.)

Modest declines in recent months have done little to bring home prices within the reach of locals. The bank’s most recent analysis declared, “unaffordability has long been a fact of life in the Vancouver housing market and this will continue to drive local buyers away.” Vancouver is a seller’s market relative to the rest of the country; RBC all but confirms that it’s a nonresident’s buyer’s market.

Garossino – who didn’t respond to a request to comment for this article – suggested that Vancouver address the situation by adopting a model similar to Singapore, where investors are limited to select areas of the city, leaving the rest of town to locals. But other observers are less confident such restrictions would work; they point out that, with no way of determining the extent of foreign investment in the local market, it’s difficult to impose restrictions.

Nicola Way, owner of upscale listings site BestHomesBC.com, said the lack of clear evidence for a foreign buying binge makes it hard to argue for investment restrictions. (See “Seeking paper trails in Asian property buying spree” – BIV issue 1168; March 13-19.)

“Until Canada can produce figures that definitively state the volume of properties bought by non-residents, I can’t see any restrictions placed on foreign ownership,” said Way.

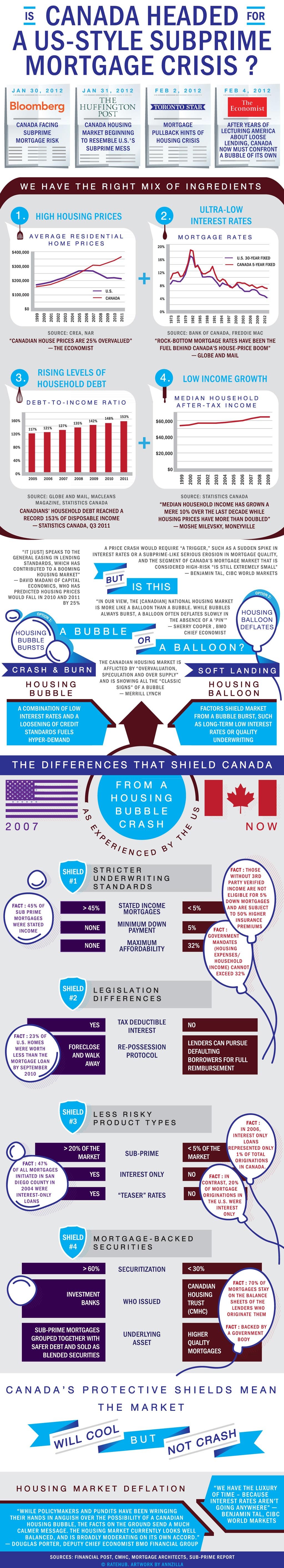

Moreover, housing affordability is more than a function of who is buying properties. Basic land economics are at play, as well as financing regimes. “There are other factors at play when it comes to Canada’s rising house prices, namely consistently low interest rates that have served to underpin housing demand,” she said. “For the City of Vancouver itself, there is also the question of land supply. We are hemmed in by geography, so when supply becomes limited, demand – and therefore prices – increase.”

Somerville goes even further. He noted that without consensus on what a foreign buyer is, it’s tough to target the restrictions. And if the flow of cash can’t be tracked, what gets taxed? “How many people are we actually talking about who are truly non-resident, non-immigrant buyers? How many people are not renting their units out but keeping them vacant?” Somerville asked. “Before we have policies to address a problem, it’d be really good to know how big a problem it actually is.”

Unfortunately, there’s no way of knowing. The statistics being thrown around are nice, but none of them have conclusively answered the question. “We don’t have the mechanisms to be really accurate,” he said. “Realtors telling me that their buyers are from China doesn’t answer it. And certainly where the appraisal chits are sent doesn’t answer it.” While non-resident purchasers could be subject to a different property tax rate, as happens in Florida, Somerville said it would have to be a province-wide measure rather than targeted to a specific city such as Vancouver or a specific part of the city. “You could always do it,” he said, “but if you put in a sub-area then you just spread the issue to other areas.”

And, hinting at his own skepticism, Somerville said developing a different tax structure or other restriction might not even be worth it relative to the scope of the problem. “Fundamentally, I don’t want to restrict the market and develop policies to address a critical problem without knowing what the problem is.”

See the original article here: BIV – Combating uncontrolled offshore ownership.

Source: Peter Mitham, Business in Vancouver