A slowdown in real estate sales numbers in Vancouver, particularly in single-family homes worth more than $1 million, dragged down the country’s average home price in September, the Canadian Real Estate Association said Monday.

In Metro Vancouver, the average home price was down 3.8 per cent in September from a year earlier, which CREA said skews the national average price, which was up 1.1 per cent. Excluding Vancouver, the national average price was up 3.4 per cent from a year ago.

Gregory Klump, CREA’s chief economist, said the drop in Vancouver was caused by fewer really expensive sales this year compared to last year.

“Last year, the average was pitched higher by a whole bunch of high-priced sales, while this year, those sales haven’t recurred so it’s lower. You’ve got one that was stretched last year, and one that’s been shrunk this year by a change in the composition that makes up the average” Klump said. “I like to use the following analogy: If you line the kids up in class from shortest to tallest and take the average height, and then you excuse the 10 tallest kids and recalculate the average, then the average height will have shrunk, but none of the kids have.”

For this reason, average house prices are not the most consistent information to use, Klump said.

“It’s like looking in a funhouse mirror,” Klump said. “It doesn’t really give you a true picture of what’s going on with regard to price, which is why you really want to look at the home price index, which keeps the quality of homes constant over time.”

The Multiple Listing Service home price index is down 0.8 per cent to $606,000 in Vancouver year-over-year in September, while it is up 3.9 per cent nationally.

“Stricter high-ratio mortgage regulation further exacerbated a moderating trend in consumer demand,” said Cameron Muir, BCREA chief economist. “Reducing the maximum amortization from 30 to 25 years had the equivalent impact to affordability as a 100 basis point increase in mortgage interest rates.”

In Metro Vancouver, the dollar volume of sales was down 35.7 per cent in September, year-over-year, figures released Monday by the B.C. Real Estate Association show.

Robyn Adamache, Canada Mortgage and Housing Corporation’s senior market analyst for Vancouver, said sales of single family homes are down 29 per cent for the first nine months of 2012 compared to the same period last year, while townhouse sales are down 20 per cent and apartment sales are down 16 per cent.

Although the overall average home price is down seven per cent, single-family home prices are down five per cent on average, while townhouse prices are down one per cent and apartment prices are down three per cent. Because more apartments and fewer houses are selling this year, the decline in average price is larger than the drop in price for any particular property.

Adamache also said there is a shift in sales volume away from very expensive single-family homes in areas such as the west side of Vancouver, West Vancouver and Richmond and toward more affordable homes in places such as Maple Ridge.

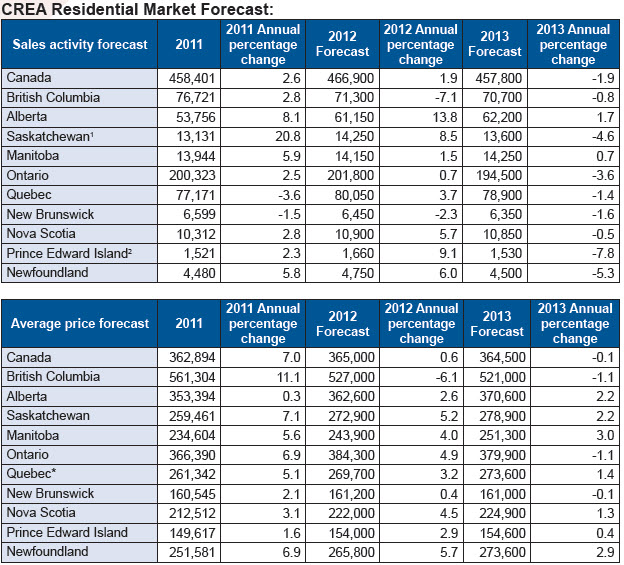

Adamache said sales numbers are expected to remain flat until the middle of 2013, when they are expected to increase, not to the lofty levels seen in 2011, but approaching those levels. She said prices are expected to decline overall this year, with a smaller decline next year.

Muir also said demand is expected to be on the rise.

“An expanding population, strong full-time employment growth and persistent low mortgage interest rates are expected to bolster housing demand in the months ahead,” Muir said.

Sales volume numbers are a lot more volatile than prices, Klump said.

“If you’re not forced to sell at a price you’re not willing to accept, you don’t sell,” Klump said. “If you’re getting offers below what you’re prepared to sell for, you take it off the market.”

Nationally, home sales in September fell 15.1 per cent from a year ago, CREA reported, adding that sales in September were up 2.5 per cent from August — the first month-to-month gain since March.

“While some first-time homebuyers may no longer qualify for mortgage financing under the new rules, it is likely that many others are stepping back and reassessing how much house they can realistically afford, which is one of the things new mortgage rules were designed to do,” Klump said.

While Vancouver’s home price index was down slightly, Calgary had a 6.5-per-cent increase in the index, the Toronto area was up 5.7 per cent, the Montreal area was up 2.2 per cent and the Fraser Valley was up 2.1 per cent.

Regina had the biggest increase among markets measured by the HPI, with a gain of 14.2 per cent from September 2011.

TD Bank economist Francis Fong said the month-over-month gain only partly offset August’s drop, with sales off their peaks in most markets across the country.

“The Canadian housing market has clearly lost some of its lustre,” Fong wrote in a note to clients.

“That being said, with interest rates remaining sufficiently accommodative, we do not anticipate any precipitous decline in housing activity in the near term. Rather, we expect a gradual unwinding of the imbalance in both sales and prices over the next few years.”

The sales report came as the Conference Board of Canada said that most Canadian cities are facing lower housing starts in the coming years as markets slow, with only 10 of the 28 cities showing positive long-term expectations.

Construction is going strong in Metro Vancouver, with housing starts on pace in September to reach 20,000 units by year’s end, mostly driven by multi-family developments, Canada Mortgage and Housing Corporation reported last week.

CREA said Monday there was still a balance between the number of homes for sale and the number of buyers in September, but conditions have eased.

The national sales-to-new listings ratio, a measure of market balance, stood at 49 per cent in September 2012, remaining near the midpoint of a balanced market.

Source: Tracy Sherlock, Vancouver Sun