CREA adjusts its home sales and price forecast for 2012 and 2013

Wednesday, September 19th, 2012The Canadian Real Estate Association cut its 2012 and 2013 outlook for home sales and lowered its national average price forecast on Monday as it reported the biggest month-to-month drop in activity in two years.

The association said that tighter regulations on mortgage lending that came into effect in July helped push August homes sales to their largest month-over-month decline since June 2010.

Sales of previously owned Canadian houses and condos have now gone down in five of the past six months.

“While we always caution that housing market trends at the national level can and do run counter to trends in many local markets, the decline in activity in August was definitely the result of much of the country moving in the same direction,” CREA president Wayne Moen said in a statement.

Sales in August slipped 5.8% compared with July and were down 8.9% compared with August 2011.

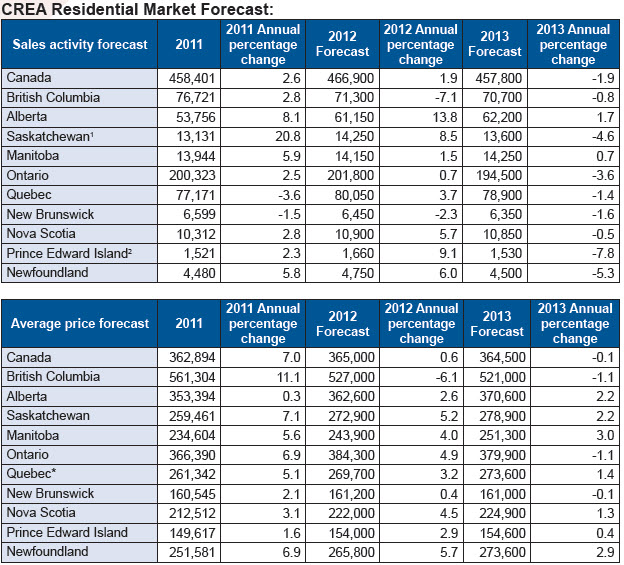

In its outlook for the year, CREA said Monday that home sales are now forecast to rise by 1.9% to 466,900 units in 2012. That compared with a forecast in June that suggested 475,800 homes would be sold in 2012, up 3.8% from 2011. CREA expects volume will slip by 1.9% to 457,800 units in 2013.

CREA also forecast the national average home price would rise by just 0.6% to $365,000 in 2012 and edge lower by one tenth of one per cent to $364,500 in 2013. The outlook was down from a June forecast that prices would rise by 2.2% to $370,700 in 2012.

TD has suggested that the tighter mortgage rules will shave five percentage points off sales activity and cut prices by three per cent on average during the second half of this year and early 2013.

In the next three years, the bank has said it expects the combination of the tighter rules and anticipated modest increases in interest rates will result in a 10 per cent price correction on homes.

CREA said sales were lower in about two-thirds of all local markets across Canada representing 80% of national activity, with lower monthly sales in almost all large urban centres, Toronto, Montreal, Vancouver, the Fraser Valley, Calgary, Edmonton and Ottawa.

“The broadly based decline in August sales activity suggests that some buyers may no longer qualify for a mortgage now that amortization periods for high ratio mortgages have been shortened,”said Gregory Klump, CREA’s chief economist.

“As the lynchpin of the housing market, lower first-time buying activity will have downstream effects over the rest of the market. While we expect it will likely take more time for move-up buyers to sell their current home, a few more months of data are needed to gauge the broader impact of recent regulatory changes on Canada’s housing market.”

Ottawa has tightened mortgage rules four times since 2008.

Among the most recent changes, the federal government reduced the maximum amortization terms for government insured mortgages to 25 years from 30.

Source: Craig Wong, Canadian Press